BlackBerry makes $4.4 billion loss, 56% drop in revenue in quarter

- Posted on

- Comment

BlackBerry reported a massive $4.4-billion loss in its fiscal third quarter and a 56% drop in revenue in its first quarterly report under new Chairman and Chief Executive John Chen.

BlackBerry reported a massive $4.4-billion loss in its fiscal third quarter and a 56% drop in revenue in its first quarterly report under new Chairman and Chief Executive John Chen.

Despite the results, Chen said on a conference call with analysts Friday that BlackBerry “has a really good shot” of turning a profit in 2016 and management will try its best to achieve the goal. Chen later laughed when an analyst wished him the “best of luck.”

The former CEO of Sybase is credited with turning around the data company that was sold to SAP in 2010. Chen said reviving BlackBerry will be his most complicated challenge but noted that the Canadian company has $3.2 billion in cash, which will “definitely allow us to engineer our turnaround.”

BlackBerry also announced Friday that it’s entering into a five-year partnership with Foxconn, the Taiwanese company that assembles products in vast factories in China. Foxconn, known for its manufacturing contract work on Apple Inc.‘s iPhones and iPads, will jointly design and manufacture most BlackBerry devices and manage inventory of the devices in an agreement that will offload much of BlackBerry’s manufacturing costs.

“I’m hoping we never have to have a conversation going forward about inventory write-downs,” Chen said.

He said Foxconn’s BlackBerry phones will be released in March or April and will be built in Indonesia and Mexico.

BlackBerry reported revenue of $1.2 billion in its third quarter ended Nov. 30, down from $2.7 billion last year.

Chen has said the company “is very much alive” but is putting more emphasis on BlackBerry’s software business than its hardware business.

“I’ll be happy to have a break-even or a low-margin device business and then have that help us to monetize software,” said

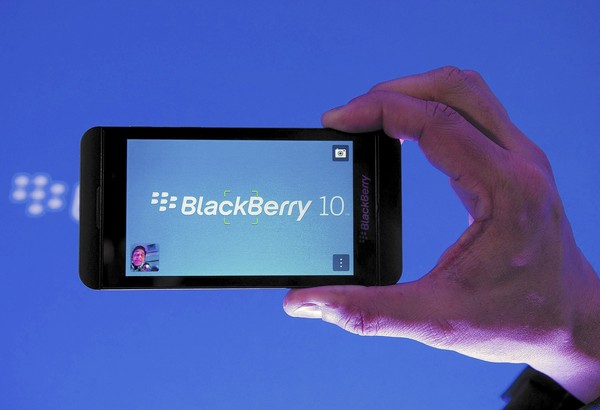

BlackBerry sold just 1.9 million smartphones in the quarter compared with 3.7 million in the previous quarter. Most of those were old BlackBerry 7 devices. This year’s launch of BlackBerry 10, its revamped operating system, and fancier devices — the touch-screen Z10 and Q10 for keyboard loyalists — was supposed to rejuvenate the brand and lure customers. But the much-delayed phones failed to turn the company around and led to a billion-dollar loss last quarter and a $1.6-billion loss in the third quarter.

“It was ugly,” said Colin Gillis, an analyst at BGC Partners.

Gillis said the Foxconn agreement may help keep BlackBerry alive by offering lower cost phones in emerging markets like Indonesia with minimal inventory risk to the company. It also allows BlackBerry to focus on designing and producing a small batch of devices for high-end business users, where security is paramount and where the company still has pockets of loyalty, he said.

BlackBerry’s net loss amounted to $8.37 a share in the latest quarter. Its adjusted loss from continuing operations, which excludes restructuring and other items, was $354 million, or 67 cents a share.

Analysts polled by FactSet, on average, expect an adjusted loss of 43 cents a share on revenue of $1.66 billion.

Shares of BlackBerry jumped after Chen’s conference call. The stock closed up 97 cents, or 15.5%, at $7.22.

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)