In its latest Economic Outlook report, Ecobank Research said foreign reserves is expected to strengthen to US$6.2 billion at the end of 2018, from US$5.9 billion in 2017.

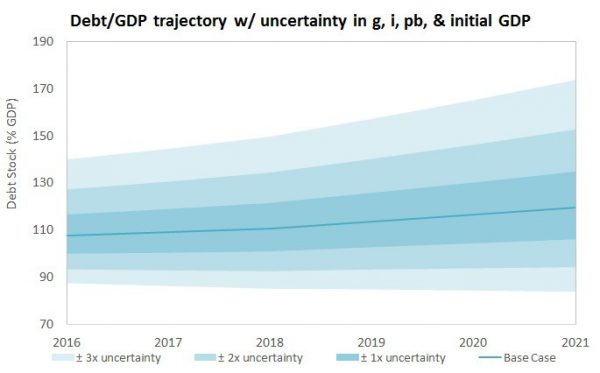

According to the 2018 Budget estimates, Ghana’s debt to GDP ratio declined from 73.0 percent at the end of 2016 to 68.6 percent at the end of September 2017. The total debt however stood at GH¢138 billion.

Ghana’s foreign exchange reserves dipped by 13.3 percent from US$ 5.77 billion in June 2017 to US$5.1 billion in August 2017, equivalent of 3.0 months of import cover.

However, the recent signing of a Cocobod loan agreement for U$1.3 billion for the 2017/18 season and increase oil production are set to provide a momentary uplift in quarter four 2017.

On real GDP, the report said the 2017-18 outlooks for Ghana appears positive amid rising energy production which will be boosted by recent court ruling in favour of Ghana’s ocean boundary with Cote d’Ivoire and increased oil prices.

Furthermore, “the commencement of production from the Tweneboa-Enyenra-Ntomme (TEN) oilfield in August 2016, and the Sankofa field in July 2017 are expected to be key factors that will help drive real GDP growth to about 7.0 percent per annum in 2017-18.

Inflation

Inflation is however forecast to decelerate significantly in 2017-18, after overshooting by large margins in previous years.

“A disinflationary trend seen since June 2016 has enabled the Bank of Ghana to implement a monetary policy easing cycle, beginning in November 2016 cutting the policy rate to 21.0 percent in July 2017, from 26 percent in October 2016.

The report noted “We expect inflation to continue to trend downwards, although higher international prices will pose upside risks via higher petrol pump prices. As a result, we expect inflation to remain close to the upper limit of the central bank’s medium-term target of 8 percent (+/- 2 percent) in 2018.

Fiscal account

The report reiterated that the fiscal deficit is expected to narrow in 2017-18 to below 5.0 percent of GDP after consolidation attempts fell off-track in 2016.

Damage to the Kwame Nkrumah FPSO resulting in oil production challenges and government revenue shortfalls, and expenditure overruns particularly later in the year amid the December 2016 presidential election caused fiscal slippages, with the deficit reaching 8.7 percent of GDP against a target of 5.3 percent of GDP.

Despite missing this target, the report stated that Ghana has made progress with IMF reforms. “Over the short-term, we expect higher oil revenues and tax reforms including measures to reduce tax exemptions and tackle evasion to reduce fiscal pressures, helping the deficit to narrow to below 5.0 percent of GDP in 2017-18, reducing financing risk.

Current account

The current account deficit is likely to narrow in 2017-18 from 6.7 percent of GDP in 2016, amid expectation of higher oil receipts and resilient gold prices buoyed by ongoing uncertainty in the global economy.

The report explained that the improved current account outlook is also based on the assumption that fiscal consolidation plans and other structural fiscal reforms will continue to be implemented helping to limit import demand.

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)