Inactive Free Zones companies face delisting

- Posted on

- Comment

At least 60 out of the 200 companies operating in free zone enclaves risk having their names delisted from the records of the Ghana Free Zones Authority (GFZA) because they have become inactive.

The authority will go ahead to delist such companies if they do not change their status over a mutually agreed period.

Additionally, the authority has instituted penalties to keep in check recalcitrant companies in the various free zone enclaves that are flouting laid down regulations.

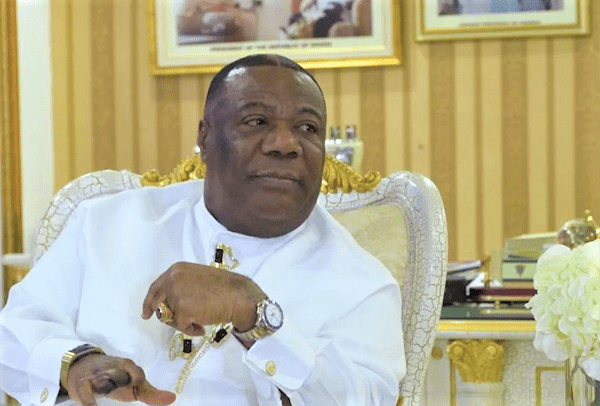

The Executive Secretary of the GFZA, Mr Michael Okyere Baafi, made this known at a media briefing in Accra on Monday to start the week-long 2018 GFZA Week celebration.

The celebration, which also marks 21 years of the implementation of the free zones concept in Ghana, is on the theme “Export-oriented industrialisation: Key to Ghana’s development.”

The celebration is aimed at increasing the visibility and understanding of the free zones concept.

Mr Baafi said the theme was chosen to reflect the current foundation of the government’s development agenda – industrialisation.

“The country also has balance of trade deficit which affects the stability of our currency. As a country, we need to export more to earn the needed foreign exchange to stabilise the cedi. Export-oriented industrialisation is, therefore, the most appropriate strategy to achieve economic development and this is what the free zones programme seeks to achieve,” he said.

The GFZA was established on 31st August, 1995 by an Act of Parliament for the promotion of economic development and to regulate activities related to free zones and related purposes.

Mr Baafi explained that the move to delist the names of the companies and institute the penalties was part of the reforms being introduced to make the free zones more viable for the government and investors.

He said for presenting false information in quarterly returns, companies in free zone enclaves would pay a penalty of $50,000, while companies that delayed in the payment of licences would pay 30 per cent of their outstanding fees.

He said the late submission of quarterly returns for the first quarter would cost a company $2,000; second quarter,$5,000; third quarter, $10,000, and fourth quarter, $15,000.

“It is expected that all the licensed free zone enterprises will adhere to the rules and regulations of the authority. However, these sanctions have been approved and published to ensure that the companies are aware of the consequences of going contrary to the act and regulations of the authority”, Mr Baafi said.

He said other measures taken by the GFZA to make free zone enclaves more viable included setting up business development and research and monitoring units, increasing the authority’s visibility, creating autonomous offices to enhance service delivery, ensuring strict implementation of guidelines for beneficiaries, a review of the Free Zones Act 1995 (Act 504) to make it more investor friendly and the strict implementation of the rules and guidelines for beneficiaries.

He said with an export-oriented industrialisation strategy, the problems of unemployment, low export earnings, lack of diversification of export products, lack of value addition to natural resources and being an insignificant player in the global chain could be solved.

Source: Graphic.com,gh

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)