BoG maintains policy rate at 16 percent

- Posted on

- Comment

The Monetary Policy Committee of the Bank of Ghana (BoG) has maintained the policy rate at 16 percent.

This is the first time the central bank has maintained the rate this year after it was reduced in January by 100 basis point to 16 per cent.

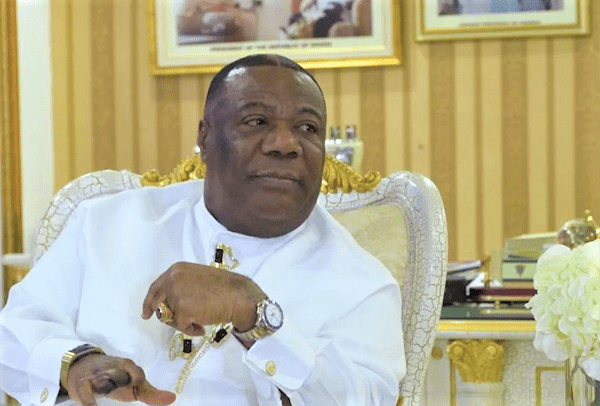

The policy rate is the rate at which the Bank of Ghana lends to commercial banks. Speaking at a press conference, the Governor of the Bank of Ghana Dr. Ernest Addison, explained that the decision was taken to control prices and also check interest rates in the financial sector.

“The Committee was of the view that the monetary policy sBtance is relatively tight and real interest rates in Ghana are comparatively high. In the circumstances, the Monetary Policy Committee has decided to keep the policy rate unchanged at 16 percent,” he posited.

Dr. Addison stated that the MPC would closely monitor developments in the coming months and would not hesitate to take immediate and decisive policy actions, including on a tighter monetary policy stance, should these risks materialize and threaten to dislodge the disinflation process.

Providing some more reasons for the decision, Dr. Addison stated that the successful conclusion of Ghana’s ECF programme with the IMF, and the need to remain steadfast in implementation of prudent policies to anchor the hard-earned stability in macroeconomic conditions was a major factor.

“In this respect, the Committee observed that there were risks to the outlook which would have to be monitored very closely. Overcoming these risks would require vigilance and time consistent policy actions”.

He cited for example that in the energy sector, large foreign exchange payments for excess capacity associated with the ‘Take or Pay’ Power Purchase Agreements has contributed to higher demand for foreign exchange hence the need to manage the situation urgently.

Dr. Addison added that the vulnerability associated with high non-resident holdings of domestic debt also poses significant risks to the fiscal consolidation process, debt dynamics, and the Bank of Ghana’s efforts at building reserve buffers, should be addressed.

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)