Nduom sues government

- Posted on

- Comment

A subsidiary of Groupe Nduom, Ghana Growth Fund Company Limited, has sued the government of Ghana over debts owed it.

A subsidiary of Groupe Nduom, Ghana Growth Fund Company Limited, has sued the government of Ghana over debts owed it.

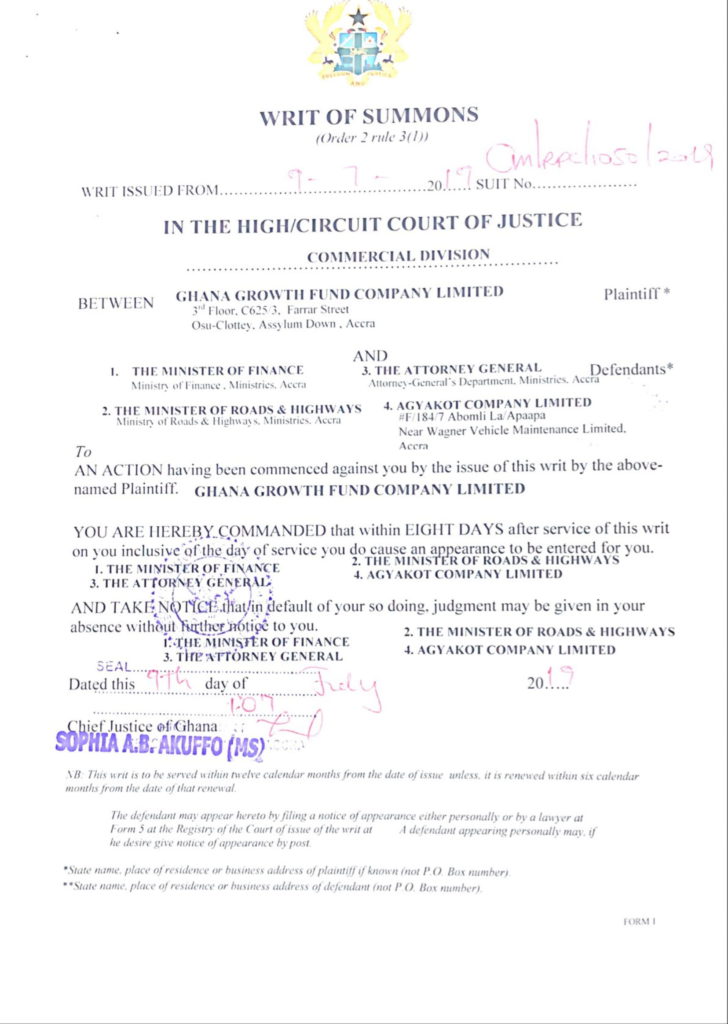

The company, in a suit filed at the commercial division of the High Court in Accra on Tuesday, July 9, 2019 said the debt owed it by government has left it in a situation where it is unable to pay investors.

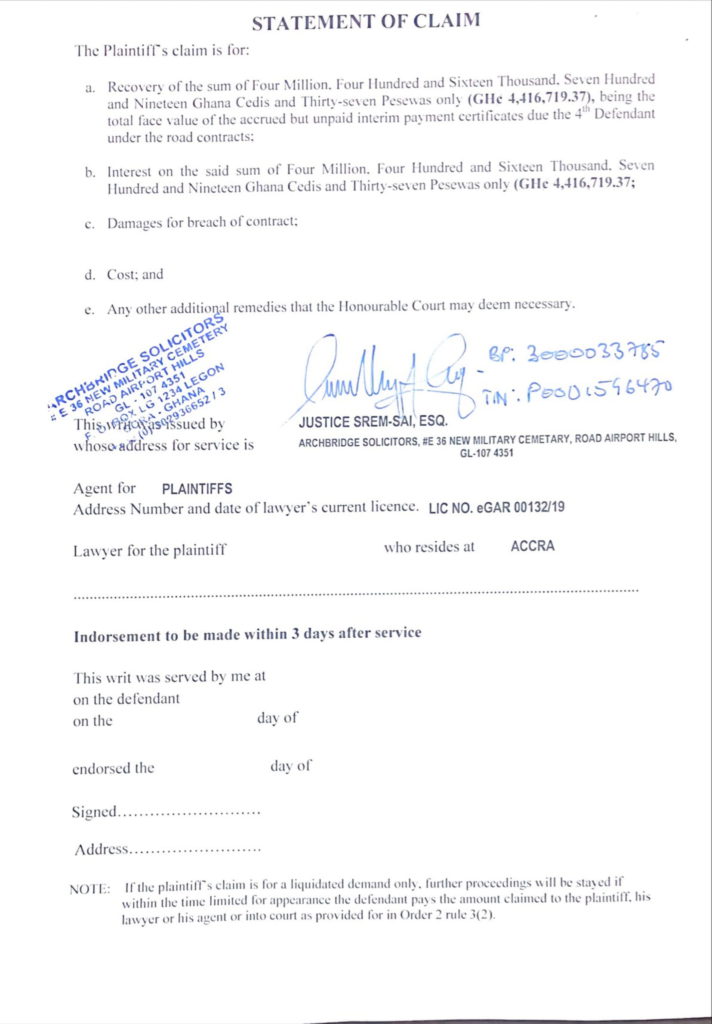

The company is thus, among other things, praying the court to help it recover the sum of “GHC4,416,719.37, being the total face value of the accrued but unpaid interim payment certificates due the fourth defendant [Agyakot Company Limited] under the road contracts”.

As part of the reliefs being sought by Ghana Growth Fund Company Limited, the suit is also asking for “interest on the said sum of GHC4,416,719.37”.

What does the Ghana Growth Fund Company Limited do?

Ghana Growth Fund Company Limited is a private equity and venture capital firm that specializes in investments at all stages of a company’s life-cycle including startups, recapitalizations, leveraged buyouts, management-led buyouts, buy-ins, expansion and development capital, mature stage, strategic minority equity investments, equity private placements, consolidations and buildups, buy and builds, and growth capital financing.

The firm also invests in property-level equity, debt and special situations transactions and businesses. It typically invests in small and medium-sized enterprises in infrastructural development, non-bank financial institutions, information technology, manufacturing, among others.

The company is a subsidiary of Groupe Nduom who manages a variety of other companies including GN Bank, First National Togo, First National Cote d’Ivoire, GN Reinsurance, GN Life Assurance, Gold Coast Fund Management, Gold Coast Brokerage, PenTrust and Liberian Enterprise Development Finance Company.

Below is a copy of the suit:

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)