NAM 1 docket ready – Attorney General

- Posted on

- Comment

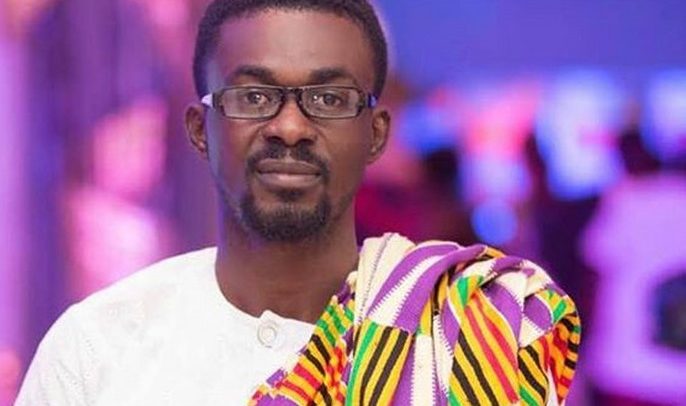

Contrary to claims that the State cannot prosecute Nana Appiah Mensah, commonly called NAM 1, Chief Executive Officer (CEO) of the defunct gold collectible company, Menzgold, the Attorney General and Minister of Justice, Godfred Yeboah Dame has revealed that dockets for financial crimes in the country are almost ready for prosecution to start.

According to him, the delay is as a result of painstaking investigations which have conducted into these crimes to gather all the facts.

Ghana recently experienced alleged financial crimes including the activities of the defunct gold dealership firm, Menzgold.

The Executive Director of the Economic and Organised Crime Office (EOCO), COP Maame Yaa Tiwaa Addo-Danquah was in the news recently over claims that the State was finding it difficult in gathering evidence against NAM1.

But such claim was later refuted by the Asante Professional Club, the group that invited the anti graft czar who said the EOCO boss was misquoted in his submission and did not say so.

Another financial crime witnessed in the country was the banking crisis, leading to the Bank of Ghana (BoG) spending over GHC25billion to clean up the sector and formation of Consolidated Bank Ghana (CBG).

However, speaking on the financial sector at Cambridge University, Mr Dame indicated that “Between August 2017 and January 2020, Ghana was hit by a severe banking crisis that affected several institutions, and several indigenous banks, as a result of which the central bank ordered a take-over of some of the banks by the Ghana Commercial Bank.

“The Central bank cited the insolvency of the banks as a significant reason for revoking their license.”

“Five indigenous banks were consolidated to form the Consolidated Bank Ghana Limited. A deeper examination of the banking crisis showed poor corporate governance, non-performing loans, breach of directors’ obligations, credit risks, and regulatory lapses.

“Internal auditors who were required to superintend proper accounting practices were complacent and covered up Executive Directors. The recent banking crisis held ramifications for the entire economy. It was the most severe economic crisis to affect Ghana since independence.

“Another phenomenon that afflicted the financial sector of Ghana between 2018 and 2020 was the emergence of many unlicensed entities operating illegally. The leaders of such entities often lived a lavish lifestyle on the proceeds of their illicit activities.

“Prominent among such entities was an amorphous organisation operating a microfinance institution under the guise of – guess what – gold trading and illegally using the name of a bank. It called itself Menzbank. Apparently, Menzgold, as it was also called, had been dealing in the purchase and deposit of gold collectibles from the public and issuing contracts with guaranteed returns to clients without a licence from the relevant authorities.

“Against caution from the Central Bank, tens of thousands of individuals got hooked on the scheme devised by the company. Following the close down by the Securities and Exchange Commission, the customers could not retrieve their funds. The company relied on the greed and ignorance of thousands of otherwise hardworking Ghanaians who were prepared to pay their life savings to the suspects in the case, resulting in losses worth millions of dollars.

“The situation caused misery and distress to many homes and unleashed a social crisis as riots and demonstrations broke out on the streets of Accra and other parts of the country. In real terms, people lost their homes, and some marriages have even broken up as a result of the Menzgold saga. Indeed, one lawyer suggested that the story of Menzgold could cause a civil war in Ghana in a manner akin to the civil war in Albania in 1997 caused by aggrieved customers of a Ponzi scheme. By the Grace of God, Ghana was saved from such a situation as a result of the prompt action taken by authorities at the helm of the financial system. I am happy to state that after painstaking investigations, dockets on that financial crime are almost ready for prosecution to commence in earnest.

“The Office of the Attorney-General is prosecuting other high-profile cases involving the offences of wilfully causing financial loss to the State, stealing, corruption, fraud, procurement breaches and money laundering. These cases have as their sole object the principle of holding public officers to account and involve sums of over $850 million.”

By Vincent Kubi

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)