Apple maintains position as world’s most valuable brand (LIST)

- Posted on

- Comment

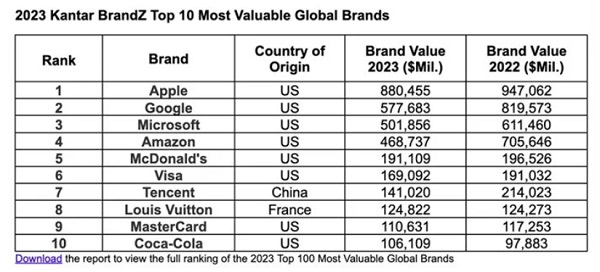

The Kantar BrandZ Most Valuable Global Brands Report 2023 reveals that Apple has retained its title as the world’s most valuable brand for the second consecutive year.

With a brand valuation of $880 billion, Apple has proven its resilience in challenging market conditions and continues to justify premium prices through positive perceptions.

The report highlights that meaningful, different, and salient brands are best equipped to navigate global economic disruptions successfully.

While the overall index of the Kantar BrandZ Top 100 experienced a 20% decline compared to 2022, it has shown a remarkable 47% growth compared to pre-Covid levels in 2019, indicating a long-term growth trajectory for brands. Microsoft has surpassed Amazon to join Google in the top three, reaffirming the dominance of technology brands in the rankings. Notably, McDonald’s is the most valuable non-tech brand, and Coca-Cola has rejoined the top 10.

Martin Guerrieria, head of Kantar BrandZ, commented on the results, stating, “This year’s results – despite the fall in aggregate value – are, in fact, a continuation of the long-term growth trend for brands, which began following the global financial crisis of 2008 and continued up until the start of the pandemic in 2020. While the market has proved volatile and been greatly impacted by global macroeconomics, consumers’ view of brands has proved far more stable – the most valuable brands in the world remain as highly regarded as ever.”

The report emphasizes the importance of building powerful connections with consumers, which enables brands to create shareholder value, resist market downturns, and recover swiftly from recessions. Brands with strong connections possess three essential qualities: they are meaningful, different, and salient.

Key highlights from the report include the growth of 16 brands in brand value within the top 100, with Airtel and Pepsi experiencing the highest growth at 24% and 17% respectively. Nine brands, including Colgate, Sony, and Pampers, have returned to the top 100 rankings. Additionally, two Chinese brands, Shein and Nongfu Spring, have entered the list for the first time. The luxury, fast food, and food & beverages categories demonstrated resilience to market fluctuations.

The report also points out that brands that can justify higher prices compared to competitors, based on strong consumer equity, have grown at twice the rate, adding 67% to their brand value over the past four years. However, sustainability remains an untapped opportunity for brands, with only 2% of the most valuable global brands perceived as leaders in this area.

Among the success stories of 2023, Pepsi’s brand value surged by 17% to $18.8 billion, earning the brand a place in the global ranking at No. 91. Coca-Cola demonstrated resilience by increasing its brand value by 8% and reclaiming a spot in the top 10 after seven years.

TikTok retains its position as the second most disruptive brand in the top 100, following Tesla. Tesla remains a true game-changer and ranks No. 1 in the automotive category with a valuation of $67.7 billion. Ferrari, although outside the top 100, entered the top 10 automotive brands with a valuation of $7.8 billion, indicating increased demand and perceived value despite challenging market conditions. Emerging brands in the electric vehicle (EV) space, such as Polestar, Li Auto, and Genesis, are predicted to gain value in the future.

The food & beverage category demonstrated resilience with only a 3% decline in brand value year-on-year. Doritos, ranked No. 19 in the category, showcased the value of superior taste messaging and functional benefits in outperforming competitors.

The fast food category emerged as the second-highest performing category, with Burger King, Chick-Fil-A, and Starbucks leading the way. Burger King’s investments in brand communications, menu simplification, and digital boards resulted in an 8% increase in value to $7.7 billion compared to the previous year.

Luxury brands maintained their allure despite incremental price increases. Louis Vuitton climbed two places to No. 8, becoming the only luxury brand in the global top 10 with a brand value of $124.8 billion. Dior experienced the highest growth in the category, increasing its brand value by 9% to $11.4 billion. This indicates that luxury brands effectively leverage their distinctive assets to drive higher demand and pricing power, even in challenging economic conditions.

Guerrieria concluded, “Brands need to continue investing in brand-building, product, and market diversification to grow. This year’s results clearly show that, even in the current macroeconomic environment, it remains possible to find growth in any category and territory with the right strategy focused on establishing and maintaining strong connections with consumers. BrandZ analysis proves that perceived difference is a key predictor of share growth. Promoting any sense of difference and making it more known and relevant to consumers will boost brand value in the long term.”

The report highlights the importance of effective marketing investment and long-term thinking for brands to achieve growth and resilience in volatile market conditions. With their strong consumer connections, the most valuable brands continue to be highly regarded worldwide, demonstrating their ability to weather market fluctuations and deliver value to their shareholders.

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)