Sam Jonah lauds govt for lithium mine agreements

- Posted on

- Comment

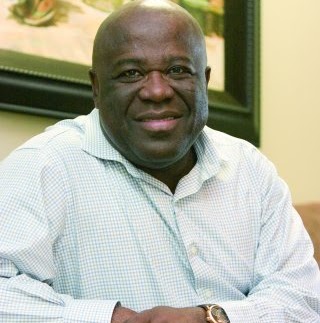

A statesman and business executive, Sir Sam Esson Jonah, has lauded the government for securing better fiscal terms for Ghana’s first lithium mine compared to those on existing mining contracts.

The former President of AngloGold Ashanti, however, stated that the country must now be strategic to help concretise the immense benefits of the electrification boom that the emerging industry promised.

Sir Sam, whose expertise in the design and implementation of better fiscal regimes for African countries is recognised globally, told Graphic Online that the terms of the lithium deal represented a credible step to actualising the increased Ghanaian ownership of the mining sector that he had long advocated.

“I have long said in my speeches that there is the need to encourage Ghanaian ownership in our mines.

This is the first credible step towards that and it needs to be praised, not condemned,” he said in an interview in reaction to the deal announced two weeks ago.

Context

Ghana has entered into its foremost agreement with Atlantic Lithium to mine lithium, a key ingredient for electric vehicles (EVs), at Ewoyaa in the Central Region.

The deal includes a 10 per cent royalty and 13 per cent free carried interest by the state, compared with the existing five per cent and 10 per cent, respectively, for other mining agreements.

In the deal signed earlier in October, the Australia-based miner is further required to pay one per cent of its revenue into a community development fund to help uplift the mining area.

Through the planned investment by the Minerals Income Investment Fund (MIIF) in Atlantic Lithium, the government has secured an additional six per cent interest in the Ewoyaa Project, bringing its total holding to 19 per cent.

“The grant of the mining lease has, therefore, not only served as a gateway for Ghana to establish a long and successful lithium industry, but also for further foreign investment,” the former Senior Consultant to the United Nations Centre for Transformational Cooperation said.

In his role with the UN Centre, Sir Sam helped Mali, Tanzania, Burkina Faso, among other African governments, to design and implement favourable fiscal terms for their mining sectors.

Potential glut

The battery metals market has become highly competitive, with countries around the world fighting to secure investment to develop their resources.

Sir Sam expressed the belief that the terms agreed for the Ewoyaa mining lease were far superior to those of many other countries, but urged the government to tread carefully to ensure that the country remained an attractive investment jurisdiction.

While commending the government for being pragmatic and proactive with the Ewoyaa lithium deal, the Chancellor of the University of Cape Coast (UCC) said it now needed to strategically move forward as time was not on its side.

“A number of states have similar or potentially even better lithium prospectives and more attractive fiscal regimes,” he said.

“Zimbabwe, for example, has a five per cent royalty rate for lithium production and no free carried state interest.

Namibia too has no compulsory government ownership and a maximum of 10 per cent royalty for mining projects.

“At Ewoyaa, Ghana has opportunity to position itself at the forefront of African lithium production and that is why the government must support the project’s development as best as it can to capitalise upon favourable current lithium prices, while regularly revisiting its fiscal terms so not to deter potential foreign investment into Ghana,” Mr Jonah said.

Price drops

Data from Benchmark Mineral Intelligence indicates that prices of lithium spodumene –high ore of the metal – will peak at $4,581 per tonne this year, before dropping consistently to $1,806 per tonne and $1,428 per tonne in 2025 and 2027 respectively.

AngloGold Ashanti’s former President said that should challenge Ghana to quicken processes towards mining the mineral while encouraging more junior companies to explore in Ghana, to maximise the likelihood of discovering a pipeline of upcoming major projects.

As new and bigger prospects from Canada, the United States of America, Nigeria, Zimbabwe and the Democratic Republic of Congo, among others, prepare to come on stream, Sir Sam stated that fears of a lithium glut were real, with the tendency to drive prices down further.

He noted that in the DRC, the Manono Project, owned by AVZ Minerals Limited, was believed to be the largest and one of the highest grade hard rock lithium projects globally.

He said the resource of the project’s Roche Dure deposit alone, one of the largest deposits of the six pegmatites – underground igneous rocks, stood at 400 million tonnes.

He said “in Mali, the combined current resources of Kodal Minerals’ Bougouni Project and Leo Lithium’s Goulamina Project equated to around 230 million tonnes”.

Sir Sam indicated that should Ghana delay in bringing its first mine on-stream, which comparatively claimed a resource of 35 million tonnes, the country could be caught up in the lithium glut, leading to bearish prices for its exports and marginalised prospects for the economy.

“The truth is lithium is abundant in the world and unless Ghana can convince investors to risk tens of millions in investments on exploration and hundreds of millions on development, the electrification boom will pass Ghana by,” he warned.

Ghana ranks bottom on lithium prospects and high on fiscal terms for investors in a list of 14 lithium developers and producers that include Nigeria, DRC and Zimbabwe.

Mr Jonah, however, noted that the $1,410 per tonne long-term spodumene pricing used to assess the Ewoyaa project meant that it remained viable and profitable even at current lithium prices, and should prices fall further.

Local processing

With the world moving towards clean energy, lithium has become a key mineral for nations and businesses, given that it is a critical ingredient in powering batteries for EVs, mobile phones, cameras, laptops and equipment in the medical field.

Sir Sam said Ghana could maximise the gains if it encouraged domestic processing of the mineral but noted that the country needed greater lithium resources and significant investment to enhance its infrastructure for local processing.

“The country currently has just the one project nearing production, with reserves of 25 million tonnes and a mine life of 12 years.

This, alongside the limitations of Ghana’s grid power, would not yet support the economics of a plant.

“But while not possible right now, I believe there is certainly the potential for a conversion plant to be built in the future, provided there is investment to further exploration to develop more reserves,” Sir Sam told the Daily Graphic.

Skilled workforce

Looking ahead, the leadership consultant said Ghana remained an attractive destination for lithium mining, given the abundance of highly skilled professionals and excellent geology and mine engineering universities that could utilise the current 15 projects in operation to improve their skillsets first-hand.

“Ghana also benefits from its coastal location and its proximity to Europe, the East and to the Americas.

Not only can this drive down capital costs, but it also enables more favourable supply channels to customers,” Sir Sam added.

-Graphic

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)