Government to spend GH¢135bn in 2022

- Posted on

- Comment

The government is seeking approval from Parliament to spend GH¢137.5 billion for the 2022 fiscal year.

The amount, which is 27.4 per cent of Gross Domestic Product (GDP), represents an increase of 23.2 per cent over the 2021 projected outturn of GH¢111.6 billion.

Out of the amount, compensation for employees is projected at GH¢35.84 billion, goods and services are also projected at GH¢9.14 billion, with interest payments projected at GH¢37.44 billion.

Furthermore, Capital Expenditure (CAPEX) is projected at GH¢16.39 billion, with other expenditure, mainly comprising Energy Sector Levies (ESL) transfers, payments to Independent Power Producers (IPPs) and financial sector costs (GAT capitalisation) also estimated at GH¢9.96 billion.

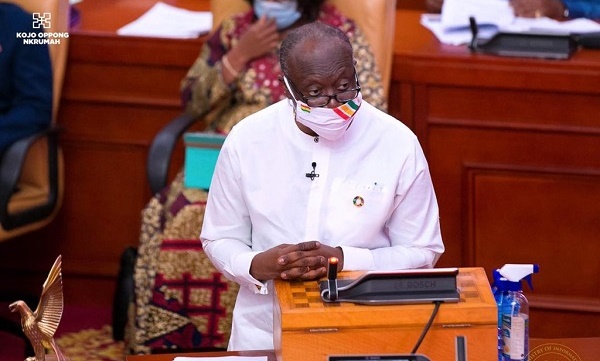

This was disclosed by the Minister of Finance, Mr Ken Ofori-Atta, when he presented the 2022 Budget and Economic Statement to Parliament yesterday.

Revenue projection

On the revenue front, total revenue and grants for 2022 are projected to rise to GH¢100.51 billion, up from a projected outturn of GH¢70.34 billion for 2021.

Out of that amount, domestic revenue is estimated at GH¢99.54 billion, representing an annual growth of 44 per cent over the projected outturn for 2021.

Of the total domestic revenue amount, non-oil tax revenue amounts to GH¢77.13 billion, constituting 77.5 per cent.

Mr Ofori-Atta said the resource mobilisation for 2022 would be underpinned by the legislation of some new tax policy initiatives to support revenue mobilisation.

He said the increase in domestic revenue by 44 per cent would be as a result of the impact of expected improvement in tax compliance, reforms in revenue administration, as well as a rack of tax policy initiatives.

Non-tax revenue (excluding oil) is also projected at GH¢10.25 billion, constituting about 10.3 per cent of domestic revenue.

Of that amount, the minister said, GH¢8.31 billion would be retained for use by ministries, departments and agencies (MDAs), while GH¢1.93 billion would be lodged, with a potential yield of GH¢152 million from the Internally Generated Fund (IGF) Capping Policy.

“Mr Speaker, receipts from upstream petroleum activities are projected at GH¢6.62 billion, representing a 23.6 per cent growth over the projected outturn for 2021, mainly on the back of an expected increase in both benchmark production and the price of crude oil,” he said.

Budget deficit

The estimates for total revenue and grants and total expenditure (including arrears clearance) are expected to result in an overall fiscal deficit (including financial costs and IPPs payments) of GH¢37.01 billion, equivalent to 7.4 per cent of GDP.

A corresponding primary surplus of GH¢435 million, equivalent to 0.1 per cent of GDP, is also projected for the year.

-Graphic

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)