Governor of Bank Of Ghana Is Now The Vice President of Ghana

- Posted on

- Comment

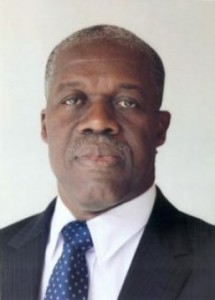

The President John Mahama, has named the Governor of the Bank of Ghana, Mr. Paa Kwesi Amissah Arthur, as his Vice-President.

This announcement comes after a period of deliberation and consultation with the NDC leadership following the passing away of the late President John Evan Atta Mills and the subsequent swearing into office of President John Mahama.

The newly named vice president, Amissah Arthur, an Economist was appointed by the late President Mills as Governor of the Central Bank on October 1, 2009 to replace Dr. Paul Acquah who served eight years as Governor.

Mr. Amissah Arthur holds a Masters Degree in Economics and has lectured in Economics at the University of Ghana and also at the Anambra State College of Education, Awka Anambra State, Nigeria.

Mr. Amissah Arthur also worked as PNDC Deputy Secretary for the Ministry of Finance and Economic Planning and continued to work in the same capacity during the first term of the Rawlings-led NDC Government.

He was among the team of technocrats who managed Ghana’s structural adjustment programme since 1980 that helped in reviving the collapsing Ghanaian economy.

Mr. Amissah-Arthur, prior to his appointment as Governor of Ghana’s Central Bank worked as a private consultant.

His choice was after a rush of intense lobbying for the vacant vice-presidential slot during which a number of high profile names within the ruling party surfaced.

Dr Kwesi Botchwey, a former finance minister during the PNDC era was also in strong contention for the slot.

The short-listing of the Bank of Ghana Governor is the culmination of a brief but stressful challenge given the long list of possibilities.

His name has automatically knocked off Goosie Tanoh and Dr Kwesi Botchwey, both front-runners in the early moments of the selection process.

Dr Botchwey, who was head-to-head with the Bank of Ghana governor, was the favourite of the old guard NDC personalities such as Captain Kojo Tsikata, while Goosie Tanoh enjoyed the support of Johnson Asiedu-Nketia, NDC general secretary.

The name of the banker will be submitted to Parliament for approval.

Credit: Citifmonline

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)