Bank of Ghana rules out special arrangement for local banks

- Posted on

- Comment

The Bank of Ghana (BoG) has indicated that there would not be any special arrangement for banks when the new capital requirement finally takes off.

The Bank of Ghana (BoG) has indicated that there would not be any special arrangement for banks when the new capital requirement finally takes off.

The Central Bank last month disclosed that it would soon be coming out to announce the new minimum capital requirement for banks this month.

JOYBUSINESS understands the regulator could settle on GH250 million as the new capital.

Local banks have always been given some exemptions in terms of timelines for meeting these regulatory requirements.

For instance when the Bank of Ghana increased the minimum capital requirement for banks from GH7 million to GH60 million in 2008, most of the local banks were given a different timeline to meet the requirement.

The regulator recently increased the requirement to GH120 million and JOYBUSINESS has learned that some of the banks are still yet to meet the GH120 million minimum capital requirement.

But Head of Banking Supervision at Bank of Ghana, Raymond Amofo says the timeline for meeting the requirement would be the same for all the banks.

Commercial Banks under the new arraignment banks will no longer be given waivers to lend beyond a fraction of their stated capital.

The banks are required to raise their capital again, based on risk and exposure, this is what the Bank of Ghana is describing as the Economic Capital.

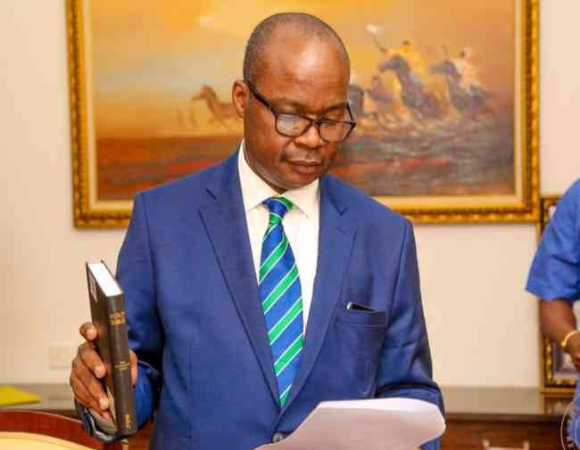

It is however not clear for now whether the new Governor Dr. Ernest Addison would sanction the timetable for implementing the capital requirements

-myjoyonline

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)