This paper understands that some banks are resorting to strategies that could enable them lobby the Central Bank to extend the December 31, 2018 deadline for them.

When the capital was increased from GH¢7 million to GH¢60 million in 2007, indigenous banks were given some extended time unlike their foreign counterparts in order to recapitalize.

The banks have at least 16 months to recapitalize to GH¢400 million, from the current GH¢120 million. But analysis of the financials of the financial intermediaries-mainly indigenous banks, indicates that majority of the 17 local banks will struggle to meet the new capital requirement if the Central Bank goes ahead and enforce the new policy by December 31, 2018.

With the exception of GCB Bank, CAL Bank, Fidelity Bank and to some extent ADB Bank that could meet the recapitalization programme with little challenges, the other indigenous banks will have to resort to mergers or probably raise equity through private placement or the stock market via Public Offer or Rights Issue.

The four aforementioned indigenous banks have their minimum capital above the present GH¢120 million requirement stated in the half-year 2017 financials, reasonable income surplus and strong shareholder structure that could raise additional capital within the shortest possible time.

Seven of the local banks are new entrants and even though they started operating with a capital of GH¢120 million, they fear losing their licenses.

Two foreign banks might struggle to meet the new minimum capital requirement of GH¢400 million but the remaining well positioned to meet the requirement.

All the foreign banks have large parent companies that have the wherewithal to inject additional capital to their operations.

For instance, Bank of Baroda is one of the biggest banks in India while Bank of Africa and BSIC have huge presence on the African continent.

Banking Consultant explains

But Banking Consultant, Nana Otuo Acheampong told Business Finder that “When the minimum capital was increased from GH¢7 million to GH¢60 million, all the banks met the recapitalization deadline. If history is a good teacher, then the banks will meet the new minimum capital requirement.”

He, however, noted that the banking industry is ripe for mergers and acquisitions, adding there might be some mergers and takeovers but could not tell the number of banks that will find themselves in this situation.

Economist and Executive Director of Centre for Economic Policy Analysis (CEPA), Dr. Joe Abbey, also told Business Finder in an interview that the need for a new minimum capital for banks is long overdue, adding, “the undercapitalization of two failed banks should warn us that all may not be well for the banking sector…….and this is not helping by the stock of NPLs registered in the books of the banks. If they don’t have the capital then the risk is being put on the depositors’ capital …..already the depositors capital is much larger than the minimum capital of the banks which is not good.”

He added that if banks cannot raise additional capital to assure depositors that it is reasonably safe to do business with them, then they cannot operate a banking business.

“We cannot have a financial sector which is very unsafe and use nationalistic reasons and say we want to promote local businesses…. We cannot allow the pyrams and the other risky happenings particularly in the microfinance sector”, he added

On whether foreign banks would dominate the industry with the new capital requirement, Dr. Abbey said he is not worried at all since in the past the industry was dominated by Stanchart and Barclays, long before GCB Bank was established, adding “we want a healthy banking sector and not a financial sector dominated by weak institutions. We want more competition and not banks dominated by locals.”

He urged the Bank of Ghana to crack the whip, saying “financial instability is very dangerous and that we should not play with concepts that we have not experienced before….at least the minimum for bank failures should serve as warnings. The regulatory body should bite no matter what.”

According to BoG, all banks are to meet the required minimum capital through fresh capital injection, capitalization of income surplus, a combination of fresh capital injection and capitalization of income surplus.

The regulator also directed all banks granted ‘Approval-In-Principle to comply with the new minimum capital levels by December 31, 2018.

Business Finder had earlier reported that even before the announcement of the new capital requirement for banks, BoG was planning to implement a recapitalization policy that could trigger mergers and acquisitions in the banking industry.

The Central Bank’s motive was to see less than 20 but bigger banks in the sector, and is said to have tasked some big banks to takeover some smaller banks if they fail to recapitalize.

Presently, there are 34 banks in the country with half of them being indigenous banks.

Citi Bank, Ghana International Bank, Exim Bank of Korea and Bank of Beirut have representatives’ offices in Ghana.

Local banks panic over GH¢400m new capital requirement

- Posted on

- Comment

MANY local banks are apprehensive and fear being swallowed by the big banks or risk losing their universal banking licenses if they do not meet the GH¢400 million (about US$93 million) new capital requirement announced by the Bank of Ghana early this week, Business Finder checks reveals.

MANY local banks are apprehensive and fear being swallowed by the big banks or risk losing their universal banking licenses if they do not meet the GH¢400 million (about US$93 million) new capital requirement announced by the Bank of Ghana early this week, Business Finder checks reveals.

By Augustine Amoah

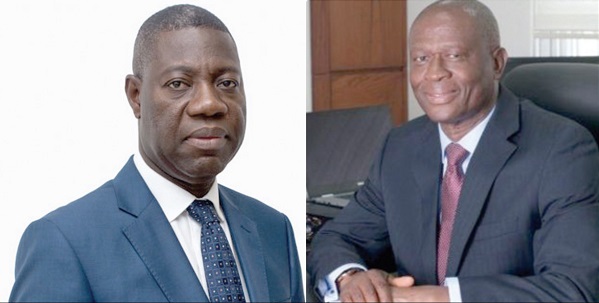

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)