ALL POSTS FILED UNDER: VAT

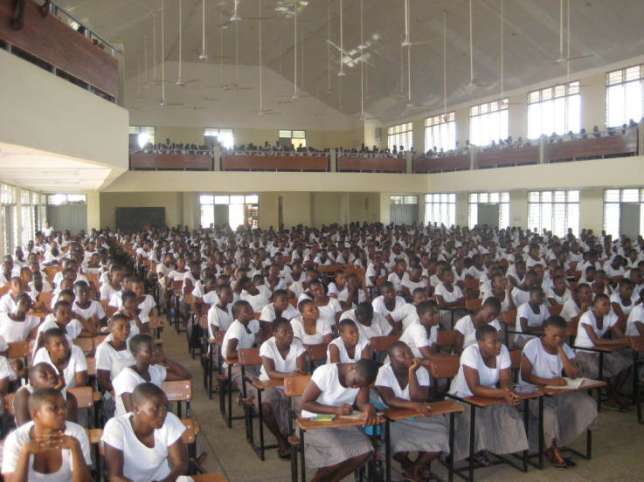

Increase VAT by 1% for free SHS project – IEA

Add a CommentThe Institute of Economic Affairs (IEA) has made a recommendation to government to increase the 17.5% VAT by 1 percent to cater for the free Senior High School (SHS) project. According to the institute, the move will provide a sustainable … Read more →

UNICOF warns against VAT on banking services

Add a CommentThe Union of Commerce Industry & Finance Workers has warned that any attempt by government to introduce the 17.5 percent VAT on some banking services would not be countenanced at all. According to General Secretary of the Union, John Esiape, they issued the warning because the Ghana Revenue Authority … Read more →

Finance workers to embark on strike over VAT on banking services

Add a CommentFinance workers represented by the Union of Industry, Commerce and Finance Workers (UNICOF) have resolved to embark on an industrial action next week unless government suspends the proposed implementation of Value Added Tax (VAT) on financial services. This was contained … Read more →

Finance Ministry says No VAT charges on salaries, savings etc

Add a CommentThe Ministry of Finance has issued a statement refuting speculations that commercial banks are supposed to charge Value Added Tax (VAT) on salaries and savings accounts. Cassiel Ato Forson, Deputy Minister of Finance who issued the statement wrote the following; … Read more →

Value Added Tax (VAT) rate is now 17.5%

Add a CommentThe new Value Added Tax (VAT) rate of 17.5 per cent has taken effect. This followed the presidential assent given the VAT Act 2013 (Act 870) on December 30, 2013, and its subsequent gazetting the following day. Under the regime, … Read more →

(Selorm) |

(Selorm) |  (Nana Kwesi)

(Nana Kwesi)